As regulations tighten, auto makers are turning to in-cabin sensing and SDVs to drive innovation and new revenue streams, says IDTechEx

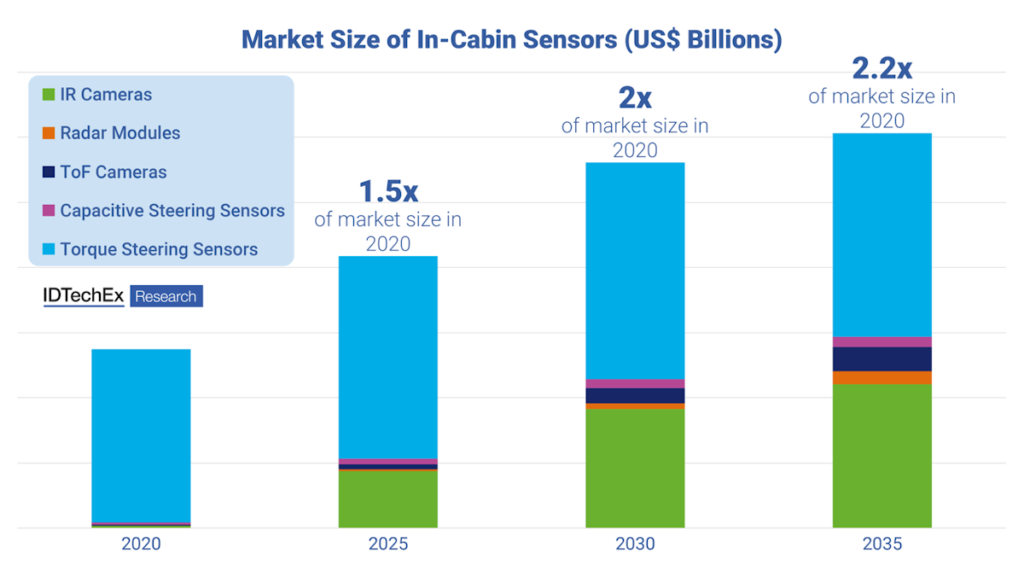

With regulatory frameworks like the EU’s Advanced Driver Distraction Warning (ADDW) approaching enforcement, automotive OEMs are increasingly combining in-cabin sensing technologies with software-defined vehicle architectures. This trend, highlighted at CES 2025, represents a significant shift in the industry as OEMs use existing hardware – such as infrared and RGB cameras – to create new revenue opportunities and improve user experiences. IDTechEx has released a report, In-Cabin Sensing 2025-2035: Technologies, Opportunities, and Markets, which explores how this convergence shapes the future of smart mobility.

In-cabin sensing: From compliance to monetization

At CES 2025, IDTechEx engaged with multiple Tier 1 and Tier 2 suppliers specializing in in-cabin sensing. A prominent trend observed was the strategic use of sensor hardware to comply with regulatory requirements and unlock novel, software-driven functionalities. OEMs are keen on monetizing in-cabin sensing systems by embedding AI-driven features that enhance personalization and safety, positioning these capabilities as key differentiators in an increasingly competitive automotive market.

For instance, the widespread adoption of near-infrared (NIR) and RGB camera modules, which serve as the foundation for driver monitoring systems (DMS), is being extended beyond mere compliance. Traditionally used to detect driver drowsiness and distraction, these camera systems are now being leveraged for driver profile identification, personalized in-cabin settings, and adaptive user experiences. AI-powered face recognition, as highlighted in IDTechEx’s report, is set to play a crucial role in the evolution of smart vehicle functionalities, enabling seamless transitions between users and enhancing vehicle security.

The expanding role of occupancy monitoring systems (OMS)

Beyond driver monitoring, occupancy monitoring systems (OMS) are gaining traction as OEMs recognize their potential to elevate in-cabin intelligence. Unlike DMS, which is largely mandated by regulations, OMS presents a more complex challenge due to the inherent limitations of current sensing technologies. A key observation from CES 2025 was the potential usage of NIR and RGB camera systems for OMS. While this offers a low-cost and technically mature solution, these systems encounter significant barriers when faced with physical obstructions, such as child seats in the second and third rows that may block NIR light. This limitation underscores the necessity for complementary and additional sensing modalities.

Radar’s emergence in in-cabin sensing: Opportunities and challenges

To overcome the shortcomings of camera-based OMS, a growing number of OEMs showcased in-cabin radar solutions at CES 2025. Operating primarily at around 60GHz, these radar modules leverage the Doppler effect to detect physiological signals, such as heart and respiration rates. This advancement introduces a new dimension to in-cabin sensing by enabling continuous health and safety monitoring, a feature particularly beneficial for detecting unattended children in rear seats. Tesla has equipped its Model Y with in-cabin radar.

However, radar technology presents a significant cost challenge despite its technical advantages. As of 2025, the unit cost of an in-cabin radar module exceeds US$35 – a price point that remains a barrier for mass adoption in cost-sensitive automotive segments. Industry insights gathered by IDTechEx suggest that with increasing production volumes, the cost per unit is expected to decrease, with some suppliers targeting a US$20 price point. Given this trajectory, IDTechEx predicts that radar-based sensing will penetrate mid- to high-end vehicle markets before becoming more widely accessible.

Software-defined vehicles: The driving force behind in-cabin sensing evolution

The ongoing shift toward software-defined vehicles is a critical enabler of these advancements. With centralized computing architectures becoming the norm, automotive OEMs increasingly deploy over-the-air software updates to enhance in-cabin sensing functionalities post-purchase. This approach not only extends the lifecycle of sensor hardware but also opens up new monetization avenues, such as subscription-based safety features and AI-enhanced personalization services.

Furthermore, IDTechEx’s research underscores the growing importance of edge AI in optimizing real-time data processing within vehicles. By integrating AI-driven analytics directly into in-cabin sensing modules, OEMs can minimize latency, enhance data security and enable real-time emotion recognition and stress detection features. These capabilities align with the broader industry goal of delivering a safer and more intuitive driving experience.

The future of in-cabin sensing and monetization strategies

As highlighted in IDTechEx’s report, In-Cabin Sensing 2025-2035: Technologies, Opportunities, and Markets, the automotive industry is at the cusp of a paradigm shift where in-cabin sensing transitions from a regulatory necessity to a core value proposition. CES 2025 has showcased how OEMs are capitalizing on existing sensor ecosystems to introduce sophisticated AI-driven functionalities, redefining user engagement and vehicle differentiation strategies.

While regulatory compliance continues to drive the adoption of DMS, the integration of OMS and radar-based sensing presents a broader vision of the future. In this vision, vehicles not only monitor but also adapt to their occupants in real time. As cost barriers diminish and software-defined architectures mature, the next decade will significantly accelerate in-cabin sensing innovations, ultimately transforming how users interact with their vehicles.