There’s a new contender in the Tier 1 automotive arena: LG is the latest tech company with designs on your car

Imagine stepping into a car that feels like your living room. The dashboard becomes a smart display, your playlist starts automatically and the lighting adjusts to your mood. This isn’t just a vehicle – it’s your smart home on wheels. The industry has struggled with connected cars but LG’s smart home expertise could be the missing link. With its Vehicle Solutions (VS) Company, LG is leveraging its consumer electronics know-how to reshape transportation.

LG VS signals a serious move into the automotive sector by the Korean giant, leveraging the company’s expertise in displays, batteries and infotainment systems. It aims to fill the gap between Tier 1 suppliers and the solutions their customers need.

“The automotive industry is grappling with the challenge of turning vehicles into ‘smart living rooms’,” explains Thilio Koslowski, a former CEO of Porsche Digital, who is now an executive advisor to several automotive companies. “Many traditional players have struggled to deliver the seamless, connected experiences consumers now expect. This need will only grow as self-driving technology matures, freeing passengers to engage with in-car environments in entirely new ways.”

He believes that success will require collaboration between traditional OEMs and companies with proven expertise in connected technology solutions.

LG already knows how to make homes smart – now it’s betting big on doing the same for cars. It is already a key player in automotive, with its existing division earning US$7.7bn last year, making it a core business.

LG’s decision to establish VS as a ‘smart life solution company’ is a strategic move to redefine vehicles as ‘living spaces on wheels’. Central to this initiative is LG αWare (AlphaWare), an innovative software-defined vehicle (SDV) solution designed to transform the in-car experience. By integrating entertainment systems with a comprehensive operating system, LG aims to extend the smart home concept into the automotive space, offering

a distinctive user experience.

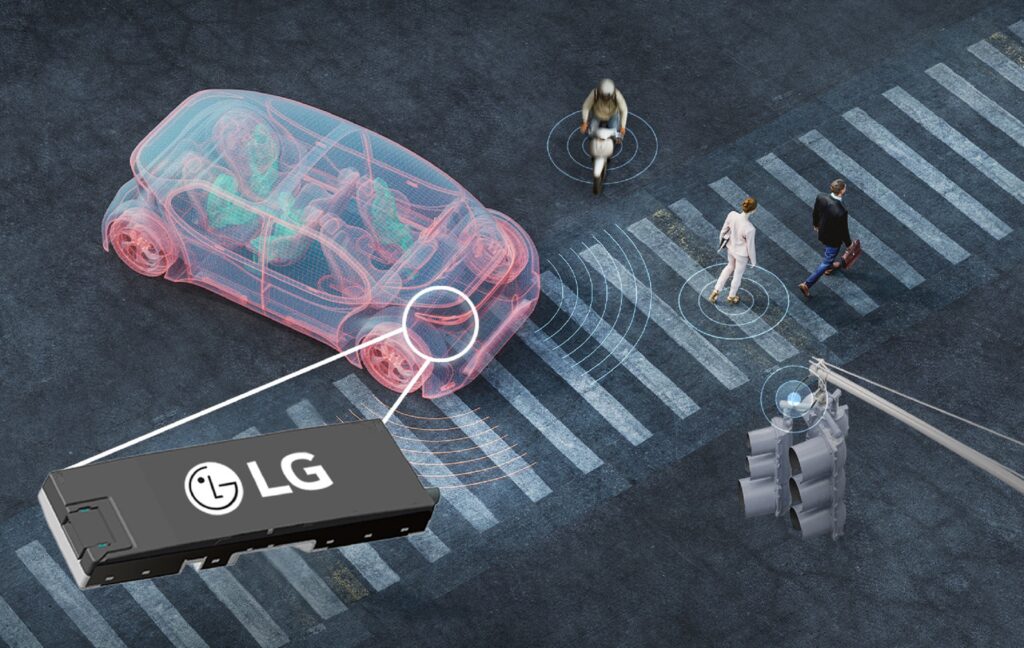

The venture builds on LG’s established presence in the automotive supply chain. “If you look inside a car,

LG Tech is a key supplier of critical modular sensors,” says Valentin Janiaut, task leader at LG VS.

“When assembling LG VS, I sourced technology from all divisions. LG Display provides panels for the automotive industry, and LG Energy Solution is a major battery supplier for electric vehicles.”

The executive says that this holistic approach uniquely positions the company to meet the growing demand for intelligent, connected vehicle environments.

LG has extensive partnerships with major auto makers including Hyundai, GM and Daimler, powering the ‘pillar-to-pillar’ screen in the Mercedes EQS. Its telematics business led the global market in Q1 2023 with a 22.4% share, according to Strategy Analytics.

The company has focused on the development of SDVs, working to create immersive, personalized in-vehicle experiences. Its vision of the ‘living space on wheels’ is particularly noteworthy, with products such as PlayWare and MetaWear aiming to transform cars into multifunctional spaces for entertainment, work and relaxation.

Lidar sucks

LG believes in a multifaceted, forward-thinking approach. Interestingly, it argues that it has been working on self-driving technology for years through lidar, originally developed for its robot vacuum cleaners, albeit with much lower stakes.

The company believes it can leverage this experience in the automotive sector. However, there remains a question about whether this technology is scalable for the more complex and demanding requirements of self-driving cars.

LG Innotek’s lidar system detects objects up to 250m away, three times the range of current tech, even in fog or snow. This is achieved through shortwave infrared rays, which reduce light scattering. To solidify its ADAS market position, LG created a dedicated lidar division and acquired 77 patents from Argo AI, bringing its total to 300.

LG has extended its influence in the automotive industry by forming strategic partnerships and leveraging expertise from other sectors. Its LG Magna e-Powertrain joint venture with Magna International goes beyond electric powertrains, incorporating an autonomous drive HMI and underscoring LG’s commitment to autonomous driving technology. Additionally, LG has strengthened its position in key areas such as cybersecurity through the acquisition of Cyberlock, and in automotive lighting with its investment in ZKW.

Strong foundations

LG’s dominance in consumer electronics – with a 16.7% share of the global TV market and its webOS holding 7.4% of the smart TV OS market – provides a strong foundation for its automotive ambitions. By leveraging its expertise in creating user-friendly interfaces and connected ecosystems, LG is well positioned to enhance the in- vehicle experience. Integrating webOS into vehicles enhances connectivity and entertainment, reflecting LG’s seamless smart life ecosystem strategy.

Such integration marks a significant step forward, as John Walsh, head of PR and communications at Genesis Motor Europe, explains: “In collaboration with Hyundai Motor Group, we developed the world’s first in-vehicle smart TV solution [with webOS]. We defined specs unique to vehicles, such as full-screen touch capabilities and sound systems, which differ from traditional TV webOS designed for home use.”

LG’s technology stack includes digital instrument clusters; AI-driven voice control; IoT connectivity, enabling seamless integration with mobile devices; and integrated media streaming services, which Hyundai was able to tailor to the in-cabin experience.

LG’s ability to transfer its TV expertise into the automotive space, combined with advances in autonomous driving and cybersecurity, positions it as a key player in the future of connected vehicles.

The collaboration goes beyond mere adaptation, as Walsh explains: “Our team worked alongside developers to ensure that the system could support both the internal needs of the vehicle and external connectivity requirements, enabling a smooth transition from home to car.”

This approach not only enhances the in-car experience but also creates a seamless extension of the smart home ecosystem, enabling users to control various home devices directly from their vehicle’s interface. Focusing on expanding content offerings through webOS in the automotive space allows the manufacturer to tap in to new revenue streams from subscription services and advertising, solidifying its position at the intersection of home and automotive technology.

LG’s strategy aligns with a broader trend in the industry, particularly evident in the Chinese market.

“If you look at China over the last two or three years, there really isn’t any separation between being a car company, a consumer electronics company or a phone company – you are everything,” notes Nakul Duggal, group general manager of automotive for Qualcomm.

“There’s no line drawn, and that’s because the people building these products are thinking about the consumer experience and where that experience is being consumed.”

This blurring of lines between industries is precisely where LG sees its opportunity. By leveraging its expertise across multiple domains – from home appliances to heat pumps and automotive components – LG is positioning itself to partner with legacy car makers to deliver a more holistic, seamless user experience that extends from the living room to the vehicle cabin.

Market opportunity

LG’s dedicated automotive division aims to fill a market gap – OEMs demanding sophisticated, integrated solutions that traditional Tier 1 suppliers struggle to provide. This shift is particularly evident when comparing approaches in different markets.

“The big challenge for many international OEMs is that they aren’t native to China, so they don’t think of their products the same way,” explains Duggal. “They’ve started to now, because if you want to be successful in China, you have to adapt, but the car is still seen as a car first. Devices may interact with the car, but it’s a loosely coupled relationship at best.”

“In China, companies like Li Auto built cars around the consumer experience, making them a smart space for productivity, entertainment, relaxation and family. They designed their cars from the ground up to meet these needs, which is something traditional OEMs are just starting to realize they need to do.”

LG’s expertise in creating connected, user-centric experiences positions it well to help OEMs close the divide and compete in markets where the car is seen as more than just a vehicle. Its move into the automotive space highlights the contrast between legacy markets and those in China. In Europe and North America, traditional OEMs have been slower to integrate connected, software-driven experiences, focusing instead on vehicle performance and engineering. LG’s expertise in consumer electronics allows it to bridge this gap, helping OEMs adapt to a market where the car is more than just a vehicle.

More silicon, less steel

LG’s decision to form the Vehicle Solutions Company isn’t just another corporate reshuffle – it’s a declaration of intent; a strategic move to position itself as a unique player in the automotive industry.

“Whether or not LG is successful is not up to the company itself,” concludes Duggal. “Legacy OEMs are the ones that are struggling because who owns the conversation is organizationally complex. In China, they’re designing the cars from the experience backwards… and don’t need Tier 1s or suppliers to fill gaps in this way.”

By drawing on its strengths in consumer tech, LG VS hopes to speed the transformation of an industry slow to adapt to tech-savvy consumers. But whether or not LG can execute its ‘living space on wheels’ vision and carve out a major automotive role remains to be seen.

This feature was first published in the January 2025 issue of ADAS & Autonomous Vehicle International magazine – you can find the full magazine archive, here. All magazines are FREE to read. Read the article in its original format here.