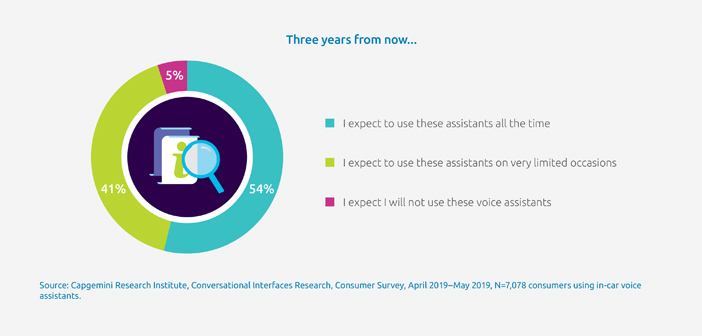

Almost every driver – 95% – will be using a voice assistant in the next three years, but automotive companies must improve the experience to meet user expectations. Those are the findings of a new research report from the Capgemini Research Institute.

The report – Voice on the go: How can auto manufacturers provide a superior in-car voice experience – looks at consumers’ adoption and expectations of the in-car voice experience. It identifies the opportunities for automotive companies to grow revenues and boost engagement through voice technology, but also finds that the industry rates the current performance of voice assistants more highly than consumers.

One key point was that not only are in-car voice assistants already being widely used, but that the trend is set to accelerate. Almost half (49%) of consumers surveyed are using voice assistants in their vehicles for a variety of functions; this figure is expected to surge to 73% in the future. At present, 77% of consumers use voice to play music and check directions (expected to rise to 85% in the future), 46% book appointments for their vehicle to be serviced (rising to 74%) and 45% order specific services such as food (72% in the future).

When asked to rate their experience using in-car voice assistants, only 28% described it as “great,” with 59% agreeing that it was, “satisfactory, but the experience needs to be improved”. A clear majority believes improvement is needed when using voice assistants to integrate with at-home systems such as temperature control (63%), providing feedback or making complaints (61%), ordering specific mobility services (60%) and booking vehicle service appointments (60%).

As well as improving the experience across key use cases, automotive companies must address concerns over privacy and data security, cites the report. Fifty percent of consumers said they do not trust voice assistants with their personal data, and 48% that they are too intrusive and seek too much personal information.

Greater customer engagement in the future has the potential to translate into revenue gains. The report found that globally, 37% of consumers said they would be willing to pay a premium or monthly subscription price for a voice subscription installed or embedded in their car and 48% said they might consider this in the future. Younger drivers were most likely to be willing to pay, including 47% of those aged 22-31 compared to 29% of 45-59-year-olds and 18% of over-60s.

“Voice assistants are becoming an essential part of how people experience cars, and safely manage their lives while on the move,” commented Markus Winkler, global head of Automotive at Capgemini. “This report demonstrates how the automotive industry should be using voice as a strategic asset both to build customer engagement and grow revenues with connected services over time.”

To access the full report, click here.